Credit Rating Unions: Your Companion in Financial Growth

Credit score unions have actually emerged as relied on allies for individuals seeking to achieve economic security and development. By concentrating on member-centric services and fostering a sense of area, credit report unions have actually improved the monetary landscape.

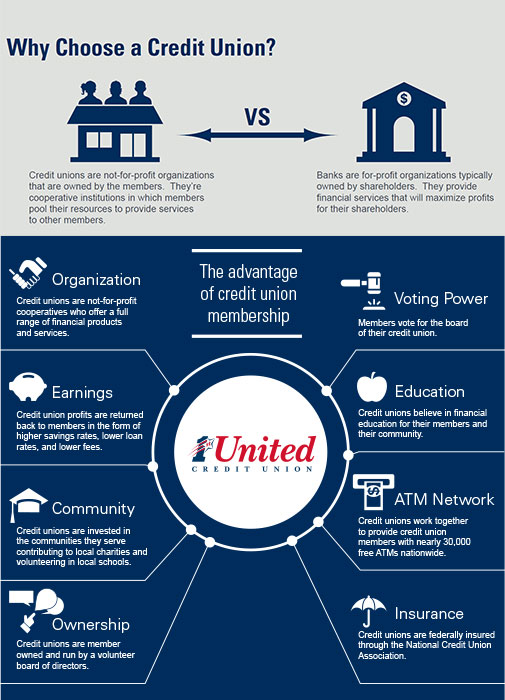

Advantages of Joining a Credit Report Union

Debt unions use a range of benefits to people looking to sign up with a financial organization that focuses on participant demands and community involvement. One considerable advantage is the tailored solution that credit scores unions give.

Additionally, credit report unions typically use affordable rates of interest on cost savings accounts and loans. Since they are not-for-profit companies, lending institution can frequently give higher rate of interest on interest-bearing accounts and lower rate of interest rates on car loans contrasted to big financial institutions. Credit Union Cheyenne WY. This can result in price financial savings for members in time and help them attain their economic goals much more efficiently

Moreover, lending institution are understood for their concentrate on financial education and learning and area participation. Lots of cooperative credit union offer monetary literacy programs, resources, and workshops to help participants enhance their financial expertise and make notified decisions. By actively engaging with the area via sponsorships, volunteer possibilities, and philanthropic initiatives, lending institution demonstrate their dedication to supporting neighborhood causes and cultivating financial growth.

Variety of Financial Products Provided

As people explore the benefits of signing up with a credit union, they will find a diverse variety of monetary products tailored to fulfill their various demands and objectives. Credit report unions regularly give customized services such as vehicle car loans, home loans, personal lendings, and credit scores cards, all designed to help participants in achieving their financial objectives.

Personalized Financial Assistance and Support

Members of lending institution gain from tailored economic guidance and support to navigate their individual economic objectives and challenges. Unlike traditional financial institutions, credit scores unions prioritize individualized solution to meet the unique demands of each member. This tailored approach begins with understanding the participant's monetary situation, objectives, and threat resistance.

Cooperative credit union specialists, usually described as member consultants, job closely with people to create personalized monetary plans. These plans might include budgeting aid, cost savings strategies, financial investment options, and financial obligation management options. By offering individually examinations, lending institution can give important insights and suggestions details to each Credit Union Cheyenne participant's conditions.

Furthermore, lending institution concentrate on enlightening their members regarding economic proficiency and empowering them to make educated choices. Via workshops, online resources, and academic products, participants can enhance their understanding of various monetary subjects, such as conserving for retired life, improving credit rating, or acquiring a home. This commitment to ongoing support and education and learning collections cooperative credit union apart as relied on partners in their members' financial journeys.

Affordable Rate Of Interest and Charges

Additionally, credit scores unions are recognized for their clear fee structures. Wyoming Credit. They commonly have lower fees compared to huge financial institutions, making it more affordable for participants to handle their funds. By staying clear of excessive charges for solutions like overdrafts, ATM usage, and account maintenance, debt unions help their members maintain even more of their hard-earned cash

Community Involvement and Social Responsibility

Credit score unions demonstrate a commitment to community involvement and social responsibility through different efforts and collaborations that profit both their members and the wider culture. These financial cooperatives frequently participate in activities such as financial education programs, neighborhood advancement tasks, charitable contributions, and eco lasting techniques. By supplying economic proficiency workshops and resources, debt unions encourage individuals to make informed choices regarding their finance, inevitably adding to the general financial health of the neighborhood. Furthermore, lending institution regularly team up with regional companies and non-profits to attend to social issues and assistance efforts that promote financial growth and security.

In addition to these efforts, cooperative credit union prioritize social duty by adhering to ethical service practices and advertising transparency in their operations. Their emphasis on serving the neighborhood establishes them apart from conventional banks, highlighting a people-first method that intends to produce a favorable effect beyond just monetary deals. With their involvement in community efforts and dedication to social responsibility, credit unions display their dedication to constructing more powerful, a lot more sustainable neighborhoods for the benefit of all.

Conclusion

Finally, lending institution play a critical duty in people' monetary growth by supplying personalized solutions, affordable rate of interest, and a large range of economic items. They offer tailored economic advice, assistance, and education and learning to equip members to make informed decisions. With a concentrate on community involvement and social duty, cooperative credit union show a dedication to developing more powerful, a lot more lasting areas. By prioritizing the financial health of their members and sustaining regional reasons, cooperative credit union develop depend on and loyalty that cultivates long-term monetary development.

Lots of credit scores unions supply financial literacy sources, workshops, and programs to aid members enhance their economic expertise and make educated decisions. Credit history unions regularly give customized solutions such as vehicle fundings, home mortgages, individual loans, and credit scores cards, all developed to help members in accomplishing their monetary goals.

Generally, the varied variety of monetary items used by debt unions caters to the varied demands of their participants, cultivating monetary stability and growth.

Members of debt unions benefit from tailored financial advice and assistance to browse their private monetary goals and obstacles - Credit Union Cheyenne WY. By focusing on the monetary well-being of their members and supporting local causes, credit rating unions develop trust fund and loyalty that fosters long-lasting monetary growth